Category: Local Events!

Bitterroot Valley Events

What Can Be Done To Correct Errors On A Credit Report?

BY GEORGE SOUTO

Mortgage and Lending with George Souto

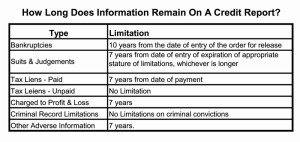

Often I pull credit reports which the Borrower claims a debt is being reported incorrectly. Fortunately we have a process to assist them for free through our Credit Report Company, but for those who do not have that option, they need to know the steps to correct the errors on their own.

Finding a debt being reported in error is not the kind of SURPRISE anyone wants to see when they are reviewing their Credit Report. So What Can Be Done To Correct Errors On A Credit Report?

As I mentioned above, when I review a Credit Report with a Borrowers, and one of their Creditors has incorrectly reported a:

Late Payment

Collection

Judgment

I first instruct the Borrower to contact the Credit Reporting Company I use, and they assist the Borrower in making the necessary disputes to correct how the item(s) is being reported on their Credit Report for free. Most Creditors report monthly to all three Credit Bureaus Equifax, Experian, or TransUnion. Therefore, the dispute needs to be submitted to all three in order to correct the mistake and adjust the Credit Scores. I instruct the Borrower to send proof the item(s) were paid to the Credit Reporting Company I use, and a dispute is filed on behalf of the Borrower with all three Credit Bureaus.

However, those who are not applying for a Mortgage, and therefore, do not have access to this free service, they need to do the following to correct the items reported incorrectly on their Credit Report.

They will need to write a letter of dispute to each of the three Credit Bureaus Equifax, Experian, or TransUnion along with proof the items they are disputing are being reported incorrectly. The letter needs to include the Trade Line, Account Number(s), and reason why they believe it is reporting incorrectly.

Under the Fair Credit Reporting Act, each Credit Bureaus must contact the Creditor or person the dispute is being filled against within 5 days of the receipt of the request. The Creditor or person the dispute is filled against then has to give a written reply back to the Credit Bureaus within 30 days of the date the dispute was filled.

The Credit Bureaus then have 5 days from receipt of the creditor’s or person’s written reply, to provide a written report with their findings. They will also need to provide a copy of a revised Credit Report if changes were made.

So what happens if the procedure above is not followed? There are 3 possible scenarios:

No response from the Creditor or person the dispute is filled against. If that happens the data is removed.

The Creditor or person that the dispute is filled against shows proof they are correct. If that is the case the data remains.

The Creditor or person the dispute was filled against acknowledges they were wrong or partially wrong, and they correct the item(s) they are reporting incorrectly.

In each of the above scenarios the person who submits the dispute must be notified by the Credit Bureaus of the results, but there is one little twist to the first scenario. If the Creditor or person who the dispute was filled against does not respond within the required time period, and the correction is made, the error can still show up later if the creditor at a later date decides to report the item again. So if the correction is made because the Creditor or person the dispute was filled against did not respond, the person who submitted the dispute must continue to monitor their Credit Report, because the error could show up again at a later date.

Everyone is entitled to one free Credit Report per year from each of the Credit Bureaus. It is wise to take advantage of this every year, so if a Creditor is reporting something incorrectly, or if fraud is going on, it can be addressed quickly.

Hopefully those reading this blog will never have anything reported incorrectly on their credit report. But if there are errors just follow the steps above for What Can Be Done To Correct Errors On A Credit Report, and the errors should be corrected within 30 days.

Check Out Rental Costs in Comparison!

First Time Buyer Check This Out!

Buying or Selling? Let a Pro Help You Thru the Process!

Buying and Selling You Need Someone to Walk You Through the Process!

HOME RENOVATION PROJECTS THAT PROVIDE THE BEST RETURN ON INVESTMENT

Written by Jaymi Naciri on Sunday, 17 January 2016

It’s not hard to daydream about shiny new countertops and fancy new appliances and one of those spa baths with a dozen sprayers and a chic soaker tub, but when it comes to home renovations, the sleek and sexy often take a back seat to the basic and boring.

“Basic maintenance, such as the roof and exterior painting, are frequently more important than an awesome kitchen,” said HGTV.

That’s the takeaway (again) from the latest Cost vs. Value Report from Remodeling Magazine, which tracks average costs and return on investment (ROI) for popular remodeling projects. The top 2016 renovation in terms of money recouped: fiberglass attic insulation, which came in at well over 100% ROI.

“For the first time, a fiberglass insulation attic upgrade was included among the list of 30 home renovation projects evaluated and proved to add the greatest value to the home at 117% of the cost of the project, according to Hanley Wood, publisher of Remodeling Magazine,” said KCEN TV.

Sound like a snoozer? Only if saving money – and energy – puts you to sleep.

“This is great news for homeowners, who know that insulation improves the comfort and energy efficiency of their home, but may not know that it adds value as well,” said Curt Rich, President and CEO of the North American Insulation Manufacturers Association on KCEN. They estimated that this project would cost “an average of $1,268 nationwide. Real estate pros, meanwhile, estimated the project would increase a home’s retail value by an average of $1,482. That’s a $116.90 return for every $100 invested.”

Key Trends in the 2016 Cost vs. Value Report

Manufactured stone veneer was new to the project list last year and came in at No. 2. It finished in the same position on the 2016 report, with an ROI of 92.9%. Next were:

Midscale garage door replacement (91.5% ROI)

Steel entry door replacement (91.1% ROI and falling from last year’s top spot)

Upscale garage door replacement (90.1% ROI)

Notice what they have in common? These four projects are all exterior, which highlights the importance of curb appeal. In fact, “12 of the 15 highest-scoring projects” in this year’s report were for “work done on the exterior of the home.”

Reflection of the Real Estate Market

Remodeling projects follow the logic of the real estate market overall. Remodeling notes that, “Gains in the new-home market are helping lift the value of remodeling projects even as costs rise.” With more money and equity can come more complex undertakings, so some “bigger and more expensive projects” also saw gains this year,” they said.

A minor kitchen remodel that costs $20,122 comes in at 83.1% ROI, up from 79.3% last year. A family room addition at a cost, on average, of $86,615 will bring a return of 67.9%, up from last year’s return of 64.1%.

But, overall, returns on these more expensive and more extensive projects were limited. By and large, upscale projects are still not providing the kind of return that would compel many homeowners to renovate if they have their eye solely on the bottom line. Among the five projects with the worst returns were:

Midrange bathroom addition (56.2% ROI)

Upscale bathroom addition (56.7% ROI)

Upscale master suite (57.2% ROI)

Upscale bathroom remodel (57.5% ROI)

Not surprisingly, the projects that are easier to accomplish and make the lowest impact on a bank balance continue to dominate the list. “As a general rule, the simpler and lower-cost the project, the bigger its cost-value ratio. Four of the five projects that cost less than $5,000 for a pro to do were ranked in the top five for cost recouped, and the remaining one was the cheapest project in the $5,000-to-$25,000 price range,” they said.

“No project costing more than $25,000 ranked better than 15th. This is in part because the simpler projects tend to require less time and skill by a professional remodeler. It stands to reason that it’s far easier to replace a steel entry door than it is to design, source, and build a two-story addition.”

NEW LED BULBS DO MORE THAN LIGHT UP

Written by Stewart Wolpin on Thursday, 14 January 2016

When the app revolution began, the smartphone suddenly started to assume the functions of what used to be separate gadgets – cameras, GPS devices, MP3 players, eBooks, handheld games, remote controls and much more.

In the same way, the smart LED lightbulb is beginning to do things other than just light up. Plenty examples of smart LED lightbulbs illuminated the show floor at the Consumer Electronics Show (CES) in Las Vegas last week.

Talk to Your Lamp

Perhaps the most aggressive smart LED bulb integrator continues to be Sengled. This company is already selling Sengled Pulse Solo, an LED bulb-plus-Bluetooth speaker, Boost, the LED bulb-plus-Wi-Fi-repeater, and most recently, the Sengled Snap, an indoor-outdoor light with an integrated 1080p Wi-Fi camera.

At CES, Sengled presented two new LED bulb-plus products: the Voice and Flex.

The Flex is a Wi-Fi speaker bulb. Like the previous Pulse Solo speaker bulb, the Flex includes dual JBL speakers and, thanks to its Wi-Fi connections, will let you tap into Internet radio stations as well as your own music collections and playlists.

Aptly named, the Voice is actually the first truly “smart” bulb, because it can obey voice commands to turn on or off, and, like Apple’s Siri or Amazon’s Echo, it can answer questions. Inside the Voice are twin microphones and JBL speakers that allow it to control not only itself, but other smart home products as well. It can also play streaming music.

Voice’s microphones can also hear potentially hazardous sounds such as barking dogs, breaking glass or crying babies. Depending on how you program Voice through its app, the bulb can transmit appropriate text alerts to your smartphone, plus signal other Voice bulbs you may have throughout your home to collectively flash or sound a siren.

Unfortunately, Sengled couldn’t say when this potentially revolutionary bulb will go on sale other than sometime this year.

Look Ma, No Wires

Other companies also presented innovations that take LED bulbs to a whole new level.

Instead of reacting to commands, Stack Lighting’s bulbs react to someone just walking into a room. Sensors built into the Stack Classic, available later this year, detect motion and occupancy and turn on or off appropriately. All of these features are customizable in its corresponding app.

Because using Bluetooth for music streaming has limited range and can degrade the sound, MIPOW introduced its two newest Wi-Fi-powered PLAYBULB bulbs at CES, and one is so smart it doesn’t even need to be screwed into a socket. The Sphere is a 6-inch-wide frosted globe that can be lit up in one of 16.7 million colors – just tap it to change colors or choose a hue from its PLAYBULB X app for either iOS or Android. Inside Sphere’s water-resistant exterior is an eight-hour rechargeable battery, which means you can place it almost anywhere. That also makes it really handy if your traditionally powered lights go out.

Natural Light

One thing LED lights do really well is change colors, from basic incandescent warm to fluorescent cold color temperatures. Taking advantage of this capability, a Russian outfit called SVET has developed a smart LED bulb that knows what time of day it is, and reacts accordingly to mimic the sunlight. For instance, SVET’s illumination will automatically soften as dusk draws near, emulating the sunset and promoting relaxation. In the morning, it gently becomes brighter and colder to emulate dawn and the morning light.

About the Author

Stewart Wolpin is a freelance journalist and longtime CES veteran. Stewart writes about consumer technology foreBay, where you can find all the latest electronic gadgets for your home.

The perks of Owning Your Own Home!

Here’s A Great Reason to List!